FAST, EASY & INEXPENSIVE

P.O. Box 69-3002 MIAMI FL 33269

Do you know the difference between a $7,500

Surety Bond and Errors & Omissions Insurance?

* What is a Surety Bond? The bond does not

protect the notary. The bond is designed to protect

the public against any act of misconduct or

negligence in the performance of your official duties

as a notary public. It does not protect you. In fact,

when a notary bond is paid to some individual who

was harmed as a result of an improper notarization,

the bonding company will usually demand repayment

from the notary. For your protection, you may want

to carry Errors and Omissions Insurance.

* What is Errors and Omissions Insurance? Errors

and Omissions Insurance (commonly called E&O) is a

form of liability insurance that protects the notary

public from claims or suits that are the result of the

notary’s negligent acts, errors and omissions. Much

like car insurance, this type of insurance covers:

investigation, defense and settlement of committed

or alleged acts by the insured notary public subject to

policy limits and provisions.

Protect yourself with personal liability insurance.

Can you afford the high cost of a lawsuit?

The State required $7,500 bond protects the public,

not you. The Bonding Company will seek

reimbursement from you even if you are wrongfully

sued.

Aaron Notary Appointment Services, Inc. highly

recommends that you protect yourself against these

high costs with an E&O policy (personal liability

coverage).

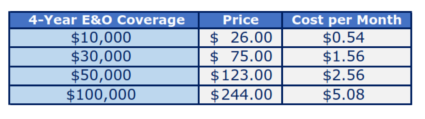

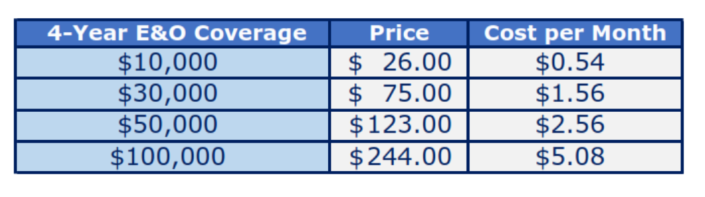

Aaron Notary has the following coverage options for

your convenience:

If you already has been appointed as a Notary Public

and would like to add E&O Insurance. Please call us

to provide you with a Quote.

THE PROFESSIONAL FLORIDA NOTARY PUBLIC APPOINTMENT COMPANY

© 2023 All Rights Reserved Aaron Notary Appointment Services Inc.

P.O. Box 693002 Miami FL 33269-3002

Phone: (305) 654-8887 or 800 350-5161 | Español: (305) 903-2388

Fax: (305) 493-3339

Contact Us | Refund/Cancellation Policy/Terms and Conditions

More Links

Free Online Notary Course

RON Notary Course

Notary Application Form

Name Change Form

Update Information Form

E&O Insurance

Apostille

Notary Search

RON Notary Search

Add/Change RON Provider Form

Wedding Ceremony

Report Lost Stamp

Notary Public Resignations

Governor’s Reference Manual

Fl Notary Statutes

Notary FAQs

More Info About Florida Notary

Request Copy of the Bond

P.O. Box 69-3002 MIAMI FL 33269

Additional Links

Aaron Notary has the following coverage options for your convenience:

If you already has been appointed as a Notary Public and would like to add E&O Insurance. Please call us to provide

you with a Quote.

Do you know the difference between a $7,500 Surety Bond

and Errors & Omissions Insurance?

* What is a Surety Bond? The bond does not protect the notary. The bond is

designed to protect the public against any act of misconduct or negligence in

the performance of your official duties as a notary public. It does not protect

you. In fact, when a notary bond is paid to some individual who was harmed as

a result of an improper notarization, the bonding company will usually demand

repayment from the notary. For your protection, you may want to carry Errors

and Omissions Insurance.

* What is Errors and Omissions Insurance? Errors and Omissions

Insurance (commonly called E&O) is a form of liability insurance that protects

the notary public from claims or suits that are the result of the notary’s

negligent acts, errors and omissions. Much like car insurance, this type of

insurance covers: investigation, defense and settlement of committed or

alleged acts by the insured notary public subject to policy limits and provisions.

Protect yourself with personal liability insurance.

Can you afford the high cost of a lawsuit?

The State required $7,500 bond protects the public, not you. The Bonding

Company will seek reimbursement from you even if you are wrongfully sued.

Aaron Notary Appointment Services, Inc. highly recommends that you protect

yourself against these high costs with an E&O policy (personal liability

coverage).

More Links

Free Online Notary Course

RON Notary Course

Notary Application Form

Name Change Form

Update Information Form

E&O Insurance

Apostille

Notary Search

RON Notary Search

Add/Change RON Provider Form

Wedding Ceremony

Report Lost Stamp

Notary Public Resignations

Governor’s Reference Manual

Fl Notary Statutes

Notary FAQs

More Info About Florida Notary

Request Copy of the Bond

THE PROFESSIONAL FLORIDA NOTARY PUBLIC APPOINTMENT COMPANY

© 2024 All Rights Reserved Aaron Notary Appointment Services Inc.

P.O. Box 693002 Miami FL 33269-3002 | Phone: (305) 654-8887 or 800 350-5161 | Español: (305) 903-2388

Fax: (305) 493-3339 | Contact Us | Refund/Cancellation Policy/Terms and Conditions

Notary Bonds and E&O

Insurance policies are

underwritten by RLI

Insurance Co. and

Contractors Bonding and

Insurance Co. a A+ Rated

by A.M. Best

FAST, EASY & INEXPENSIVE